Who holds the power in Champagne - the growers who own the land, or the houses that make the wine? Andrew Jefford tracks a case of love thy enemy

Ferrari? Jumbo jet? Ocean liner?

No analogy will suffice when it comes to summarising the commercial power of the wine world’s most successful region.

Champagne sales stand at record levels. In 2007, the Champagnois sold almost 339 million bottles, some 46 million more than a decade earlier.

The value of those sales (about €4,200 million before tax) has never been higher. The price of every grande marque Champagne has risen steadily over the decade, well ahead of inflation.

To growers in La Mancha or Moldova, Moët at £26 a bottle, Laurent- Perrier at £32 and Bollinger at £35 must seem phantasmagorical. Especially when you consider that there are 24 million of those bottles of Moët sold every year.

But Champagne is fully planted – planted until the pips squeak, as land values attest. An average hectare in the Languedoc (2007 figures) will set you back €10,700 (£8,300), and in the Loire Valley €26,100/ha (£20,300/ha).

Fancy Burgundy? In that case, you’ll need €87,000/ha (£67,700/ha). Don’t ask about Champagne, though. A hectare there (assuming you could find one to buy) will cost €734,000 (£572,000).

That’s a 17% price rise over 2006. Not much has changed in 2008, either. This is the land the credit crunch forgot. A revision of its boundaries is underway, but it will be more than a decade before immigrant grapes top up the tanks.

Now let’s add a further fact to this mix. The growers who own the vines sell only 22.8% of Champagne. The houses sell 67.8% of Champagne, but own very little of the land.

(Some, like Pommery and Lanson, were stripped of everything they once owned via repeated sales. Everyone looks with envy at Roederer’s 214ha, accounting for two-thirds of its needs.)

The result is an enormous tug-of-war between 20,024 growers, who want to maximise the return on what is usually a tiny holding (the average Champagne grower owns just 2ha), and the 200 or so buyers for the Champagne houses and large cooperatives, all of whom are desperate not to lose their share of a fiercely competitive, highly profitable market.

The growers are holding back more of their grapes every year, and any purchaser who dares reject grapes for qualitative reasons has to watch his supplier walk straight into the arms of a rival.

As I write, battle is about to recommence. A small army of 100,000 seasonal workers is heading for Champagne to begin the 2008 harvest (hand-picking obligatory).

Who cracks the whip – those growing the grapes, or those selling the bottles? To try to answer the question, let’s look at what’s going on behind the scenes.

If you’re imagining long lines of tractors ambling up and down Epernay’s Avenue de Champagne while their Gauloisepuffing drivers scan courtyards looking for the best price chalked up on a blackboard, think again.

Almost every grower knows, long before the event, exactly where their grapes are going to go, and it’s generally not very far.

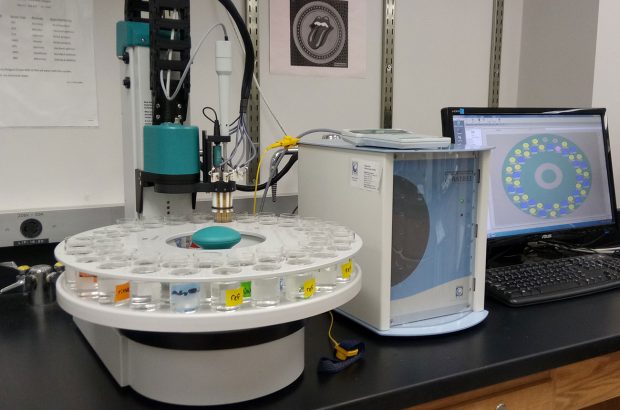

About 70% of growers belong to co-ops or other sorts of community enterprises, and almost every village in Champagne will have one or more pressing centres – there are 1,866 scattered among the region’s 320 communes. Some of these pressing centres belong to co-ops; others belong to merchant houses; most are independently owned.

They press grapes into juice, and it’s the juice which goes off to a smaller number of vinification centres, many of them based with the merchant houses or the biggest cooperative groups in Reims or Epernay.

Almost every grower has a contract for his grapes, and between 70% and 80% of those contracts have been arranged by a courtier, a middleman, who is paid 1% of the ransaction’s value by the purchaser.

This is true even for those growers who belong to a coop. Indeed, Champagne co-ops play a very different role to that in other French regions in that they, too, function as a kind of polyvalent intermediary.

They press 40% of the region’s grapes, about half of which is contracted directly to Champagne houses; many smaller co-ops produce no Champagne of their own. At the other extreme, 35 million bottles of co-op Champagne each year are labelled with the names of 2,700 individual members.

The result of all of this is that each Champagne harvest produces a tornado of paperwork, as 280,000 tiny parcels of fruit are pressed in 1,866 different places and then move on (sometimes in consolidated form) to thousands of different eventual destinations. Keeping track of these transactions is what makes the courtiers worth their 1%.

But therein lies one of Champagne’s structural flaws – 200 buyers cannot monitor the quality of fruit in 280,000 separate vineyard parcels. Many are unlikely ever to see that fruit, but will simply take receipt, from a third party, of a tank of must as soon as possible after pressing.

Few growers are willing to speak about this on the record, but several have confirmed to me that all that is required to sell unallocated Champagne grapes is a 30-second telephone call. They’ll be bought, unseen, with gratitude and alacrity. Another grower asked his potential négociant purchaser if he wanted the fruit sorted before delivery.

Don’t bother, was the answer. But surely the contract will stipulate the qualitative parameters? It does, in three words: sain, loyal et marchand (‘healthy, authentic and market-worthy’). You don’t need to be a lawyer to find the wriggle-room in that time-worn phrase.

Aÿ is a magnificent sight: a great sweep of south-facing hillside, rising unevenly from the Marne and its sister canal, curling round the combe that lies beneath the Bois de Charlefontaine, then swinging off to face east where the river Livre has stumbled down from Fontaine.

Looking up from the town, two things are obvious, especially to anyone who knows nearby Burgundy.

One is terroir: quality will vary greatly depending on where a vineyard lies on that undulating, rumpled hillside. And the second is human nature: some growers will be better and more assiduous viticulturalists than others.

Yet, incredibly enough, everyone expects the same price. Not officially: the EU banned the CIVC (the Champagne trade association) from fixing reference prices.

But it takes more than a note from Brussels to change a regional mindset.

If you look at the Champagne courtiers’ official website, www.spcvc.com, you will find the reference price for a kilo of grapes from every one of Champagne’s villages in the 2005 harvest (in Aÿ, a grower would have expected €4.64 per kilo, whereas downriver at Azy sur Marne, a grower would only have got €3.95).

Of course, nothing is to stop a négociant paying more for top quality (or for organic grapes); the best will certainly do this, and will check on the quality of what they have bought, too.

‘We’re small enough,’ says Bruno Paillard, talking about his own house, ‘to visit each of the village pressing houses where we buy at least twice every harvest to check on the quality.’

At Bollinger, says vineyard manager Gilles Descotes, ‘every employee gets involved at vintage, and the directors themselves hit the road to check on the pressing houses which we use.’

To give you an idea of scale, Bollinger has to buy 40% of the grapes it needs. Some 80% of this comes directly from 350 growers, and the other 20% from 14 co-ops.

As these figures suggest, checking every parcel in the vineyards first is impossible.

‘Négociants,’ points out Jean- Baptiste Geoffroy, ‘tend to think about villages rather than parcels, because of the volumes they have to handle each vintage.

Working parcel by parcel would be a nightmare for them. That’s what growers like me have to offer in our Champagnes – a reflection of the parcels of origin. ‘The négociants try their best to develop good relations with their suppliers, but they all need grapes – desperately.

Most of them have expanded their commercial activities by up to 5% in the past five years. The stock situation has got incredibly tight, and each house tries to outdo the other both psychologically and financially to attract and keep hold of grape supplies.’

Paillard admits that his house never refuses a delivery of grapes. ‘Even if the quality is bad, we understand that accidents can happen in our climate. Indeed they frequently do, and they tend to be very local.

If the fruit is unusable, we declassify it to tailles (second pressings) which we sell off anyway. We aren’t always satisfied with the fruit we buy, but to be truthful we aren’t always satisfied with the fruit from our own vineyards, either, for the same, often accidental reasons.

If it’s not good enough, that gets sold off, too.’

Carol Duval-Leroy says that her company has occasionally refused fruit for quality reasons, but that it’s very hard to find replacements, so most know they are better off working with growers longterm to avoid problems happening in the first place.

The president of Champagne’s courtiers, Yves Fourmon, says working with growers right through the season to maximise quality at the level of the parcel is another of his members’ tasks.

So the answer to our question looks increasingly obvious: under present conditions, the growers hold the power. Unless recession deflates Champagne sales, that will continue to be the case. Yet, on its own, this power is of little use, since the houses control access to the markets.

It’s like owning the engine of the Ferrari, but not the wheels or the body. Growers

and houses need each other. At present, relations are so strained that one top house’s vineyard director described the situation as ‘like a war’.

Growers are both the enemy, in that quality is never ideal, and the ammunition, to be hidden from rivals and then used to firelight your way to greater market share.

From the consumer’s point of view, this war and its rules of engagement dent quality.

Geoffrey says that, in his view, the co-ops, which occupy much of the middle ground, deserve some credit for distinguished conduct, since their advantageous tax situation and the fact that they receive subsidies means that they have been able to greatly improve overall pressing standards by investing in new equipment in recent years.

‘Nonetheless, given the volume crushed and vinified, it’s impossible to achieve the brilliance which a perfectly exposed parcel, harvested at ideal maturity and vinified in small volumes, can give you.

What the big houses aim for is consistency.’ At present, impeccably ripened fruit from the best parcels ends up in prestige cuvées and the very best grower’s Champagnes. In an ideal world, there would be a lot more of it, since it would be identified rather than lost in the mass, and the standard of non-vintage cuvées would rise accordingly.

‘Every system can be improved. But you can’t decree quality by contract,’ says Duval-Leroy. ‘It’s the consequence of nature and individual will. For us it comes from sticking with our growers, giving them both confidence and advice, and entering into a true partnership with them.’

Paillard also points out that ‘quality in Champagne is a much broader question than simply looking at grape supply’. Other decisions – selling off the tailles, using reserve

wines, giving wines the time they need to mature perfectly, not using dosage to hide faults and letting wines rest after disgorgement – are in his view equally important.

Will improvements come? Only with time, says Descotes.

‘Time to strike up deep relationships with suppliers; time to convince them of the importance of quality (which is why we taste the still wines with them); and time to get them to accept our demands and to understand that everyone benefits in the long run.’

But on the battleground, time is in short supply.

Written by Andrew Jefford