Wine investment: Modest growth for top Burgundies

Burgundy has continued to show mixed signals in an uncertain market going into 2026, but some blue-chip wines recently crept back into positive price territory after significant corrections.

Get our daily fine wine reviews, latest wine ratings, news and travel guides delivered straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Average Burgundy prices fell by a few percentage points last year, yet there was a slight upturn from June, said international merchant Bordeaux Index and its LiveTrade online trading platform.

Having surged prior to 2023, a number of top-tier Burgundies have undergone relatively big price corrections in a subsequent secondary market downturn. Have prices bottomed-out?

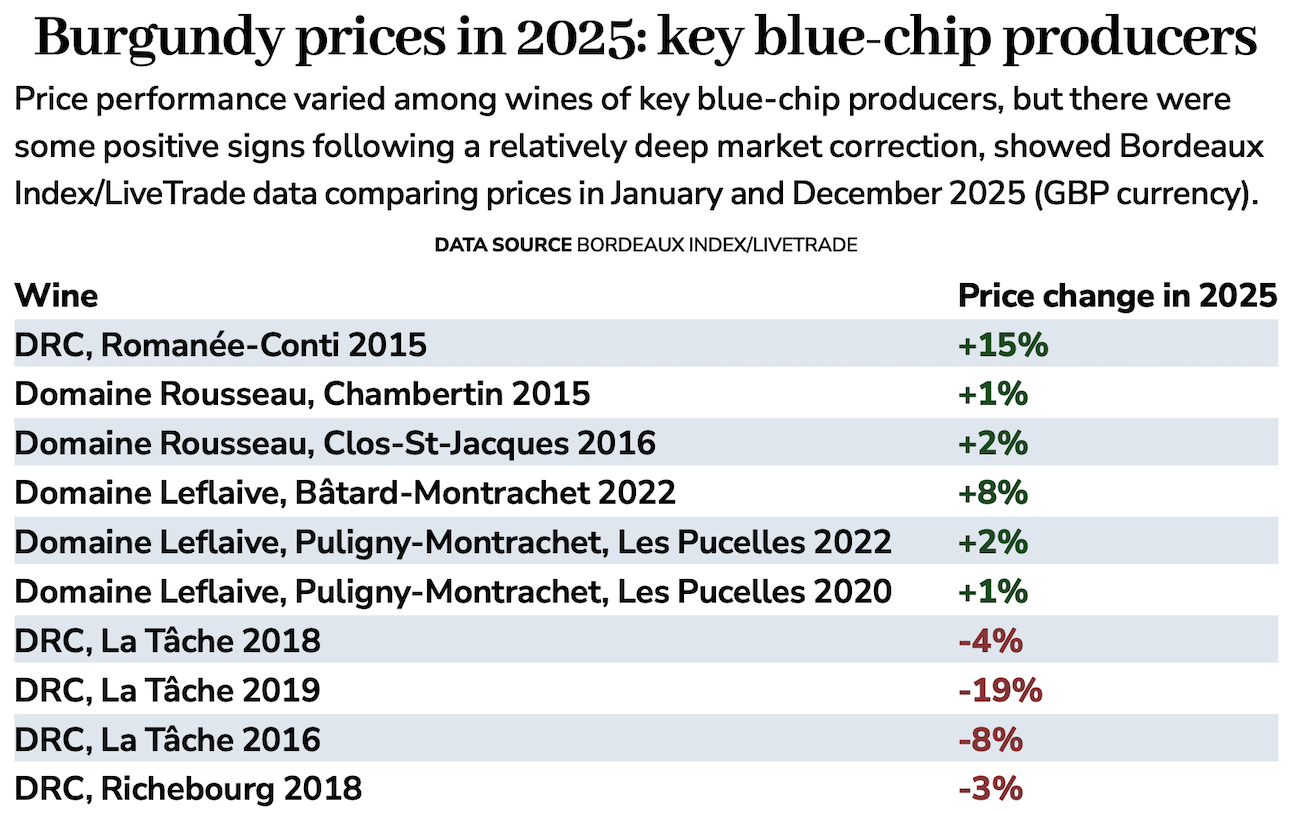

Price performance varied between wines in 2025, with rises and falls, said Bordeaux Index’s Geraint Carter (see table). He highlighted growing positive sentiment around a few blue-chip producers, including Domaine de la Romanee-Conti (DRC), Domaine Armand Rousseau and Domaine Leflaive. They have a track record of trading and some top wines have dropped 25%-40% in price in about three years.

‘Having that market correction is important in making a case for a sale,’ Carter said. Some wines were still double their price 10 years ago, noting ‘longterm holders of these wines are sitting on big paper profits at current levels’.

Liv-ex, a global marketplace for the trade, reported a rising bid-to-offer ratio for wines in its Burgundy 150 index, which also increased 1.1% in value in November. The index was still down 4.4% year-to-date, but Liv-ex said: ‘At the very top end of the market, price stability does appear to be returning.’

In November, Miles Davis, market expert at Vinum Fine Wines, which has offices in the UK and Asia, reported relatively good demand for vaunted names such as Domaines Roumier, Coche-Dury, DRC, Rousseau and Leflaive, as well as opportunities – having recently offered a super-rare, 12-bottle case of Roumier, Bonnes Mares 1995.

On the auction scene, recent results have fostered confidence. ‘There’s still huge global demand for Burgundy,’ said Tim Triptree MW, international director for wines and spirits at Christie’s, noting a well-established secondary market driven by scarcity and thirsty collectors.

Get our daily fine wine reviews, latest wine ratings, news and travel guides delivered straight to your inbox.

Still, there was a feeling among some merchants that patient bidders hold a strong hand. Bordeaux Index’s Carter said that, beyond a small group of blue-chip producers, Burgundy ‘remains a very fragile market’.

Fine wine & spirits specialist Bordeaux Index kindly sponsors this section of Decanter, and provides its view on the market here every issue. It can be found at bordeauxindex.com.

The story in Burgundy, much like the broader market, has become one of recovery; however, it’s important not to lose sight of the fact that prices remain materially down for the year to date. The modest rebound since the mid-summer lows is real but so far concentrated on a narrow set of wines with proven trading histories and, crucially, dramatic multi-year price corrections.

Outside these areas, liquidity remains worryingly thin. Large segments of the market are effectively un-bid, with offer prices that are frequently optimistic to the point of delusional.

Until pricing adjusts, particularly among mid-tier producers, the market will struggle to find broad-based momentum. A little context is essential when considering Burgundy.

Yes, the market is down more than 30% since 2022, but it has still more than doubled over the past decade. Many long-term holders are sitting on substantial paper profits and, in theory, should be willing future sellers.

Yet, on the other hand, the fact that they haven’t sold during three years of declines suggests that their attachment is strong. More broadly, Burgundy is often portrayed as a home for the passionate aficionado, in contrast to Bordeaux or Champagne, where cynical investors tend to predominate.

This characterisation is being tested more than ever, and the outcome will do much to determine the direction of prices in the months ahead.

Coming up

Taste Burgundy en primeur

Various UK-based merchants have scheduled Burgundy 2024 en primeur tasting events for January 2026, open to collectors who wish to taste the young vintage for themselves. Berry Bros & Rudd, Jeroboams, Corney & Barrow and wine club Honest Grapes were among those listing Burgundy en primeur tastings in London. Decanter’s full Burgundy report will be published in the week commencing Monday 19th January.

Domaine de la Romanée-Conti 2023 release

Not all Burgundy estates follow the same timetable, and the region’s fabled Domaine de la Romanée-Conti tends to release new vintages once bottled. Its class of 2023 is next up and merchant Corney & Barrow, UK agent for DRC, said it planned to offer the wines from early February 2026 onwards.

Brunello di Montalcino 2021

January 2026 marks the official starting point for the first Brunello di Montalcino 2021-vintage releases, though winery schedules will vary. This is a top-rated year for Tuscany more broadly. A full Brunello di Montalcino report by expert Michaela Morris is coming soon to Decanter Premium online.

An ‘incredible auction moment’

Adam Bilbey, Christie’s global head of wine and spirits, during the La Tâche 1886 sale.

Eye-catching prices for historic French-origin wines lit up the festive auction scene in early December, bringing down the gavel on 2025 in style. All lots found buyers when Christie’s auctioned historic wines from the cellars of Burgundy’s prestigious producer-merchant Bouchard Père & Fils in early December.

Total sales hit almost £2.38m, and the star lot was a single bottle of Bouchard Père & Fils, La Tâche 1886. It fetched £325,000, including buyer’s premium, eclipsing a pre-sale high estimate of £19,000. It’s an example of what can happen when bidders set their sights on a particular opportunity.

‘There was a round of applause when the hammer came down,’ said Tim Triptree MW, international director of Christie’s wine and spirits department. ‘There was spirited bidding,’ he said, adding provenance, rarity and Bouchard’s high-quality reputation combined to create this ‘incredible auction moment’.

Among other highlights, a bottle of Bouchard Père & Fils, Clos Vougeot 1857 sold for £47,500 (high e: £14,000). Individual bottles of Bonnes Mares 1865 and Romanée-St-Vivant 1861 each sold for £68,750 (high e: £15,000 and £14,000 respectively).

Triptree said results were another encouraging sign for the fine wine market in general. Fellow auction house Sotheby’s also hosted a major sale of Lafite Rothschild wines in Paris, including bottles sourced from the Bordeaux first growth’s cellars.

A bottle of Lafite 1870, a lauded vintage, sold for €100,000 (£87,335), including buyer’s premium (high e: €60,000).

Disclaimer: Decanter’s Market Watch pages are published for informational purposes only and do not constitute investment advice. Wine prices may vary and they can go down as well as up. Seek independent advice where necessary and be aware that wine investment is unregulated in several markets, including the UK.

Related articles

- Wine investment: Signs of a fine wine market reawakening

- Wine investment: Tough trading for California’s blue-chip labels

- Wine investment: Why the Super Tuscans are bucking the trend in a weak market

Chris Mercer is a Bristol-based freelance editor and journalist who spent nearly four years as digital editor of Decanter.com, having previously been Decanter’s news editor across online and print.

He has written about, and reported on, the wine and food sectors for more than 10 years for both consumer and trade media.

Chris first became interested in the wine world while living in Languedoc-Roussillon after completing a journalism Masters in the UK. These days, his love of wine commonly tests his budgeting skills.

Beyond wine, Chris also has an MSc in food policy and has a particular interest in sustainability issues. He has also been a food judge at the UK’s Great Taste Awards.